Swyftx, the top-notch crypto exchange in Australia, boasts the largest number of supported currencies and trading volume among Aussie exchanges. With top-notch security and stellar customer service, it’s the go-to exchange, mate! Let me give you the lowdown on Swyftx.

About Swyftx

Swyftx is the exchange with the highest liquidity and tightest spreads in Australia. It offers over 200 different cryptocurrency pairs, not just Bitcoin but also a variety of altcoins.

Anyone from anywhere around the globe can open an account and use Swyftx, not just folks living down under in Australia.

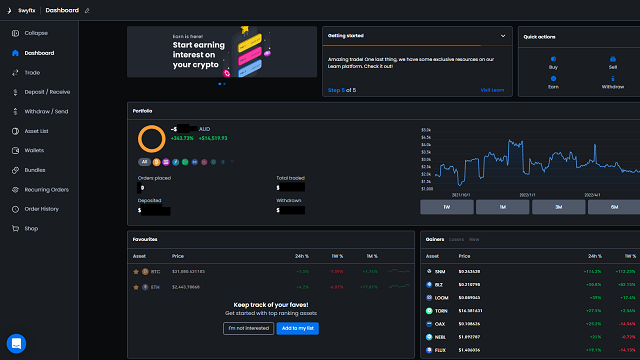

With its simple and user-friendly trading interface, even beginners can easily buy and sell cryptocurrencies. That’s why Swyftx has earned high ratings from consumers on popular Australian review sites like Trustpilot and Product Review.

The reason Swyftx boasts the best liquidity and tightest spreads among Australian exchanges is because it references order books from exchanges worldwide. This allows Swyftx to offer users the best rates from exchanges with the highest liquidity. When there’s high trading volume, frequent buying and selling, and an active market, liquidity increases.

The order book, also known as the ‘market depth,’ is like a live list of buy and sell orders that haven’t been executed at the current moment, meaning they haven’t been fulfilled. In highly liquid exchanges, the order book is updated in real-time.

When a sell order placed by a seller or a buy order placed by a buyer is fulfilled, it means the order has been processed, and either the item has been sold or bought.

The liquidity of an exchange usually correlates with its trading volume. If there are few traders participating in trading, the frequency of buying and selling decreases. This results in situations where orders placed at desired prices may not be fulfilled because there are either no buyers at the desired price or no sellers. This indicates low liquidity.

Conversely, high liquidity means there is a high trading volume, numerous orders in the order book, and the currency is traded at relatively stable prices at any given time. With high liquidity, you can buy or sell currency more quickly at prices closer to your desired price.

The order book of smaller Australian exchanges can’t compete with major global exchanges in terms of liquidity. When liquidity is low, there can be significant deviations from the average prices of global markets or wider spreads.

The spread refers to the difference between the buying and selling prices on an exchange. A wide spread means there is a significant difference between the selling and buying prices. A narrow spread means there is little difference between the selling and buying prices, indicating that the desired prices of sellers and buyers participating in the exchange match. Generally, when there are fewer participants (sellers and buyers) in an exchange, the spread widens. When there are more participants, demand increases, leading to narrower spreads.

However, many exchanges intentionally widen spreads to increase profits. The wider the spread, the more the exchange can sell to buyers at higher prices and buy from sellers at lower prices. Therefore, caution is required with exchanges or marketplaces with abnormally wide spreads, even if they have low fees. Wide spreads can lead to losses.

In this regard, Swyftx, boasting the best liquidity and tightest spreads in Australia, provides peace of mind. You’ll understand this when comparing spreads across different exchanges.

At Swyftx, the trading fee charged for buying and selling is 0.6%, which is at the lowest level domestically. In most Australian exchanges, trading fees range from 0.8% to 1%.

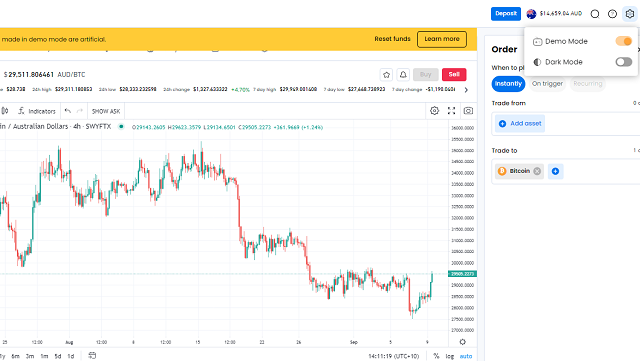

Moreover, on Swyftx’s trading interface, users have access to chart display features powered by TradingView, a platform utilized by traders worldwide. This allows users to view real-time charts of various timeframes for each currency pair denominated in Australian dollars.

Additionally, there’s a demo mode available where you can try out all the buying and selling features without actually using real money. So if you’re unsure about how to use it initially, you can practice trading until you get comfortable.

Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Cainlink (LINK), Litecoin (LTE), Polkadot (DOT), Cardano (ADA), Bitcoin Cash (BCH), Binance Coin (BNB), Stellar Lumens (XLM), Maker (MKR), Uniswap (UNI), Compound (COMP), Aave (AAVE), yearmfinance (YFI), NEO (NEO), Texos (XTZ), Synthetix Network Token (SNX), Algorand (ALGO), Tether (USDT), Dogecoin (DOGE), EOS (EOS), Monero (XMR), VeChain (VET), Cosmos (ATOM), NEO (NEO), Filecoin (FIL), Dash (DASH), Sushi (SUSHI), Zcash (ZEC), Basic Attention Token (BAT), Horizen (ZEN), Kiber Network (KNC), Ocean Protocol (OCEAN), Power Ledger (POWR),

Over 300 crypto-currencies lested

How to Open Swyftx Account

Below are the steps to open an account with Swyftx and set up security measures.

Account opening and identity verification

If you follow the instructions, your account opening will be completed in just a few minutes.

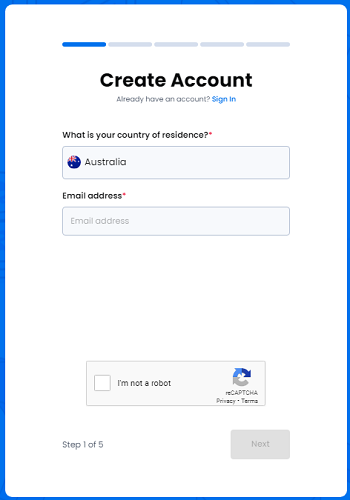

First, go to the Swyftx website. When the screen with ‘Create Account’ appears as shown below, select your country of residence, enter your email address, check the checkbox next to ‘I’m not a robot’ for the displayed CAPTCHA, and click ‘Next.’ You can also select countries other than Australia (Japan is also acceptable).

Then, to verify the email address you entered, a 6-digit code (number) will be sent to your email. Enter that code. Again, when the checkbox for ‘I’m not a robot’ for the displayed CAPTCHA appears, check the box and click ‘Next.’ Please note that you may encounter an error if you don’t check the CAPTCHA box before entering the 6-digit code.

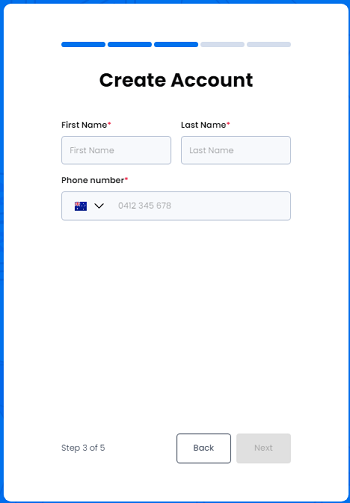

Next, you’ll need to input your name and phone number. If you’re creating an account from a country other than Australia, for example, the UK, make sure to select the UK in the phone number input box.

Then, to verify the phone number you entered, a 6-digit code (number) will be sent to your phone number via SMS (text message). Enter that code.

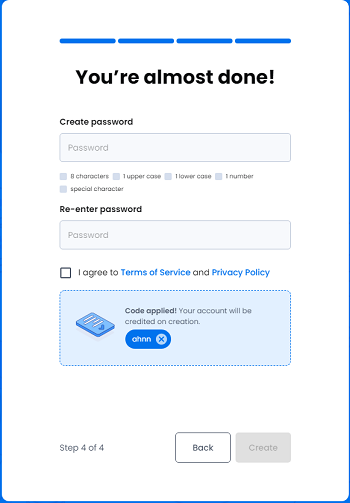

On the next screen, you’ll set up a password to log in to your account. It should be at least 8 characters long and include at least one uppercase and one lowercase letter, one or more numbers, and symbols such as ‘@’, ‘#’, ‘*’. Enter the password twice. Check the box agreeing to the Terms of Service and Privacy Policy (‘I agree to Terms of Service and Privacy Policy’), then proceed to the next step.

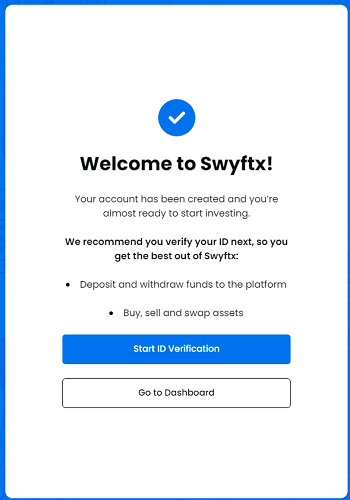

Your account creation is now complete. Note that you won’t be able to deposit, withdraw, or trade until you complete the ID verification process.

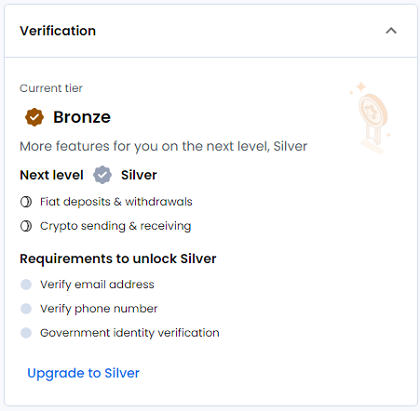

Right after account opening, your Account Status will be Bronze. Bronze status indicates that you haven’t completed any ID verification (Know Your Customer – KYC) procedures. As a result, you won’t be able to deposit, withdraw, or trade. You’ll only have access to the demo trading feature for practice.

KYC stands for Know Your Customer, which refers to the process of identity verification required by financial institutions and exchanges during account opening. Typically, this involves submitting identification documents and a photo (selfie) to prove one’s identity.

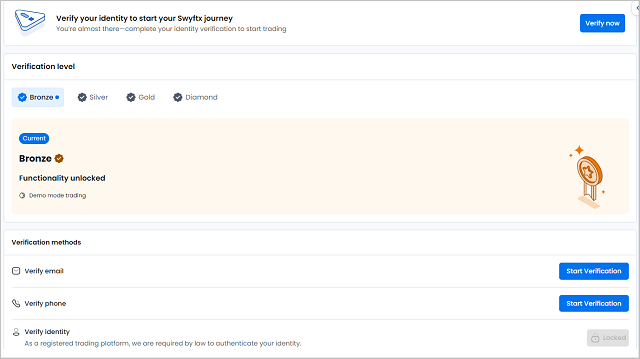

In this state, the account isn’t functional at all. Therefore, you’ll need to undergo ID verification. You can click on ‘Start ID Verification’ as shown in the account registration completion screen above, or if you’ve logged out and logged back in, you can click on the ‘Verify now’ button displayed on the dashboard, which is the first page you see after logging in.

It’s possible to open an account even from outside Australia. This article explains with an example of Australian residents who have bank accounts within Australia.

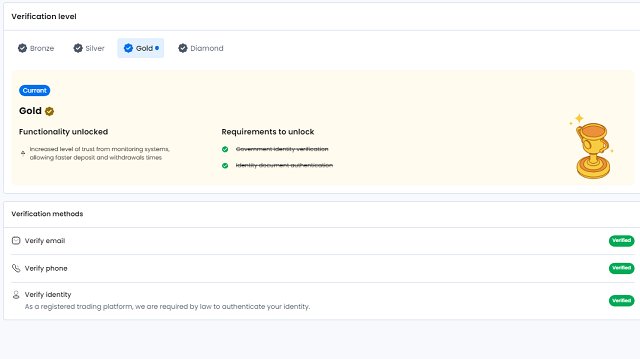

Then, you’ll be directed to a screen displaying the current verification level as shown below.

Firstly, there’s the verification process to confirm whether the registered email belongs to the user. You should receive an email requesting email address verification to the email address you provided during registration. Please click on the confirmation link in that email. Once confirmed, the ‘Verify email’ section will show as ‘Verified.’

Next is the phone number verification. Similarly to the registration process, enter the 6-digit code (number) sent via SMS to your phone into the popup window. Once entered, the ‘Verify phone’ section will also show as ‘Verified.’

The above steps are for reconfirming the email address and phone number registered during the account opening process.

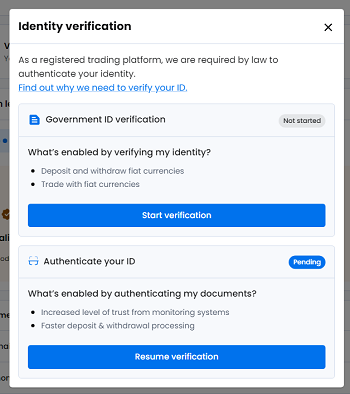

Next is the ID verification.

Click on ‘Resume verification’ in the ‘Verify identity’ section. Then, in the popup window that appears, enter the required information (name, address, date of birth), and select the type of ID you’ll be submitting. The ID must be issued by a government agency in your country of residence. Valid forms of ID include a driver’s license, passport, Australian visa, citizenship certificate, Medicare card, and others.

A window will appear for entering the information from the selected ID. When entering the information, please ensure that the personal information you input matches the information stated on the ID you will be submitting.

Enter the information, then check the box next to ‘I agree …’ at the bottom, and click on ‘Verify these details.’ This will change the status of the Identity box to ‘Verified.

Once you’ve completed this simple online identity verification process, your Account Status will change to Silver. At this level, you’ll be able to deposit Australian dollars and trade cryptocurrencies against the Australian dollar.

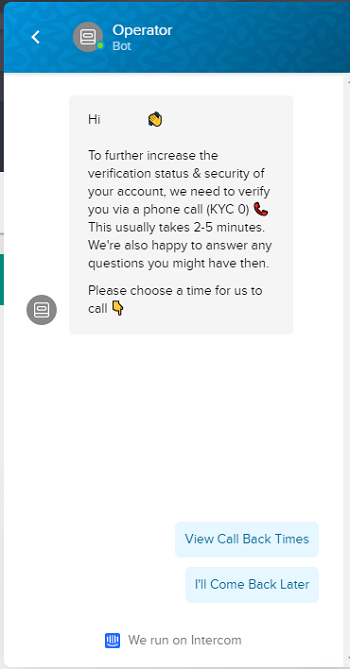

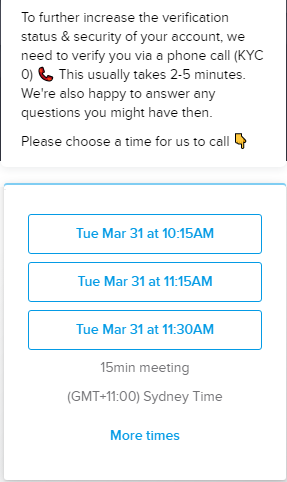

To further upgrade your Account Status to Gold and enable withdrawals in Australian dollars, you’ll need to undergo a phone-based identity verification by Swyftx staff (2-5 minutes), as well as submit a selfie holding the ID you provided, using either your PC’s webcam or smartphone camera.

These instructions will be displayed in the chat on the right side of the screen, so please follow the instructions provided by the chat operator. If you don’t see any instructions, click on ‘UPGRADE NOW’ on the Account Status screen.

The selfie process typically takes about 5 minutes online. However, please note that if the photo is blurry or too dark, you may need to retake it. If a retake is necessary, you’ll receive instructions via email.

The identity verification via phone call from Swyftx staff involves scheduling a specific date and time to receive the call via chat. Then, Swyftx staff will call you at the designated time. The call typically involves identity verification and a few brief questions, usually lasting just a few minutes.

Once all of these steps are completed, your account will be upgraded to Gold status, enabling deposits and withdrawals in Australian dollars.

Here’s a summary of the features available for each account status:

| Deposit | Withdrawal | Trade | |

| Bronze | Crypto only | Crypto only (Up to $20,000 AUD equivalent) | Crypto only |

| Silver | AUD & Crypto | Crypto only (Up to $20,000 AUD equivalent) | AUD & Crypto |

| Gold | AUD & Crypto | AUD & Crypto (Up to $50,000 AUD equivalent) | AUD & Crypto |

| Diamond | AUD & Crypto | AUD & Crypto (Above $50,000 AUD equivalent) | AUD & Crypto |

To further increase the daily withdrawal limit beyond $50,000, upgrading to Diamond status is required.

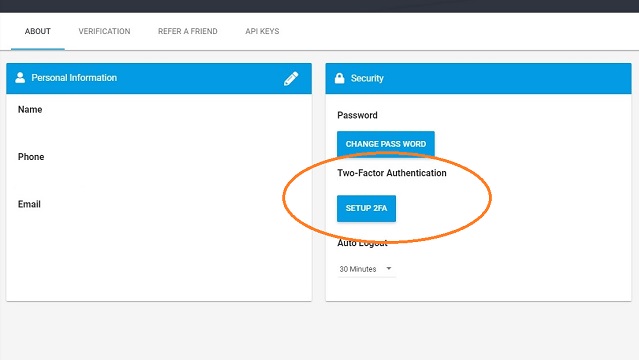

Security Settings

Let’s set up Two-Factor Authentication (2FA) for login. 2FA, also known as Two-Step Verification, adds an additional layer of security to your login process by requiring both your password and another form of authentication, typically a 2FA code. You can install a 2FA app on your smartphone.

It’s become standard practice on cryptocurrency exchanges to use 2FA codes for login. Many reports have highlighted instances where users have had their passwords stolen and their funds withdrawn due to not setting up 2FA. It’s crucial for security.

Make sure to set up 2FA as soon as you deposit funds into your account. To use 2FA, first download and install the ‘Google Authenticator’ app on your smartphone, whether it’s an iPhone or an Android device.

Once the installation on your smartphone is complete, open the Swyftx account menu on your PC and select ‘About.’ Then, click on ‘SETUP 2FA’ in the ‘Security’ section. Once 2FA is enabled, it becomes mandatory for every login and cannot be disabled. If you agree, click on ‘YES, I AM SURE’ in the popup window with the cautionary note.

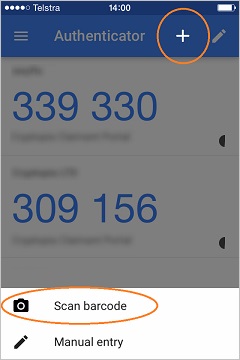

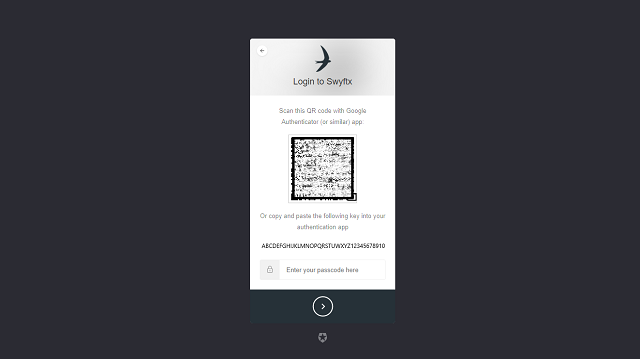

Next, a QR code will be displayed. Open the Google Authenticator app on your smartphone, and click on the ‘+’ icon at the top of the app. Then, select ‘Scan barcode.’

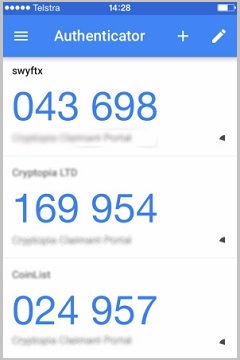

Scan the QR code with your smartphone camera, and Swyftx will be added to the list in the Authenticator app.

The 2FA code displayed changes every 30 seconds. Within the next 30 seconds, enter the 6-digit 2FA code from the Authenticator app into the blank space below the QR code displayed on the Swyftx site.

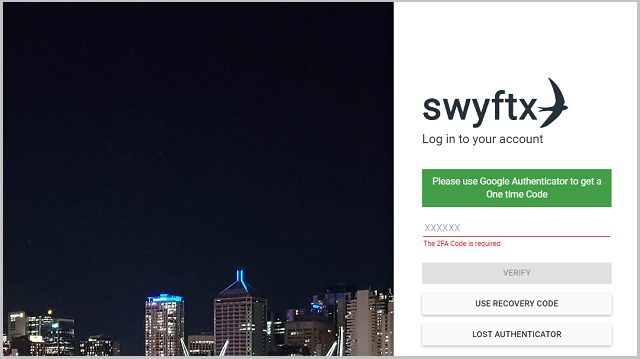

Your 2FA setup is now complete. From now on, when logging into Swyftx, entering the 2FA code will be required.

Deposit and withdrawal Methods

Here, we’ll explain the methods for depositing and withdrawing Australian dollars and cryptocurrencies to and from your Swyftx account.

Depositing Australian Dollars

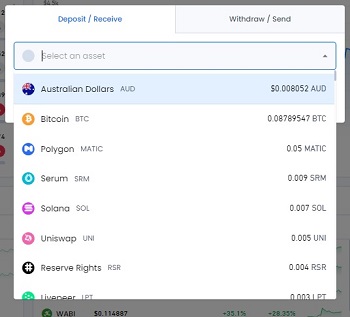

Select the dollar icon from the menu, then choose ‘Deposit/Receive.’ From the dropdown menu labeled ‘Select an asset,’ choose ‘Australian Dollars.

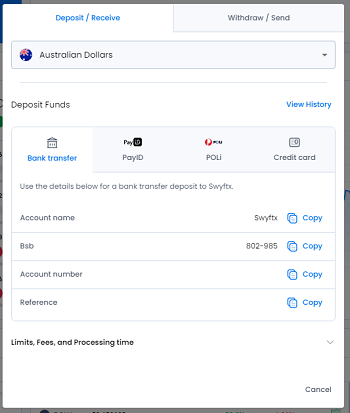

Then, you’ll see a screen where you can select the deposit method using tabs, as shown below.

You can choose from bank transfer, credit card, PayID (a simple payment method from supported financial institutions), and POLi (an online payment system supported by several financial institutions).

Here, we’ll use bank transfer as an example to explain. When making a bank transfer at your bank, you’ll need to input the account name (Swyftx), BSB (branch number), account number, and the word displayed in the ‘Reference’ field. The word displayed in the ‘Reference’ field is usually the account holder’s name (your own name). Make sure not to forget to input this word in the ‘Reference’ field of the bank transfer.

Once you initiate the transfer from your bank account, you should see the deposit reflected in your Swyftx account shortly.

Withdrawing Australian Dollars

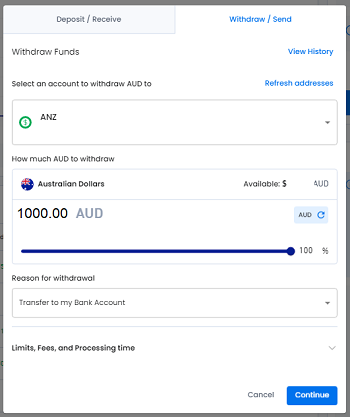

When you select ‘Withdraw/Send’ from the menu and choose ‘Australian Dollar’ from the ‘Select an asset’ dropdown menu, you’ll see a screen like the one below

In the ‘Select an account’ dropdown menu, choose your own bank account. If it’s not registered yet, select ‘Add a new account’ and proceed with the registration.

When registering, input the name of the account holder, account number, and BSB (branch number). In the ‘Label/Note/Name’ field, you can assign any name you prefer to easily identify the account later. Then, click on ‘ADD’ to add the account information.

Once added, you’ll see the account listed with the status ‘Confirm email.’ You should receive a confirmation email with the account details to the registered email address. Click on ‘Confirm Address’ in the email. It will redirect you to the login page where you’ll need to log in again.

When withdrawing, please input the withdrawal amount. If you’re withdrawing the full amount, slide the dot below the amount to the far right to reach the 100% position. Choose the most appropriate option for ‘Reason for Withdrawal?’ If you’re unsure about the withdrawal reason, selecting ‘Transfer to my Bank Account’ should suffice.

Afterwards, click on ‘Continue’ at the bottom right. If you have two-factor authentication set up, you may be prompted to enter a code. Once completed, the deposit to the designated bank account will be reflected immediately.

Depositing Cryptocurrencies

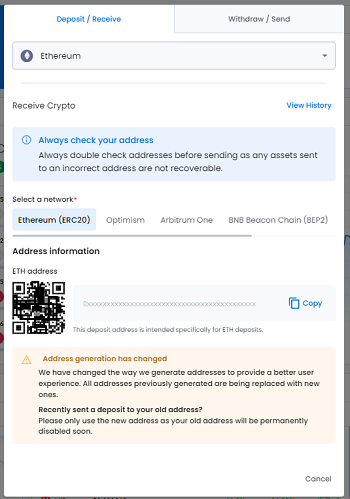

The basic operations are the same as the Australian Dollar deposit and withdrawal mentioned above. Select ‘Deposit/Receive’ from the menu, then choose the desired currency from the dropdown menu under ‘Select an asset.’

In this example, you would choose Ethereum (ETH).

Upon doing so, your unique deposit address will be displayed along with a QR code. Use this address to transfer funds from external exchanges or wallets.

You’ll receive a notification via email once the deposit is confirmed. Major cryptocurrencies like Bitcoin, Ethereum, Ripple, etc., are processed promptly.

Withdrawing Cryptocurrencies

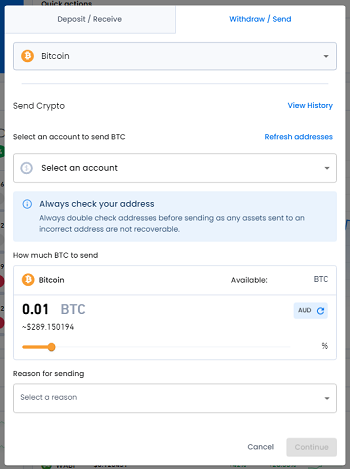

If you want to withdraw cryptocurrency to another exchange or your own wallet, start by selecting ‘Withdraw/Send’ from the menu, then choose the desired currency from the dropdown menu under ‘Select an asset.

In this example, you would choose Bitcoin (BTC).

When withdrawing, please enter the withdrawal amount. If you wish to withdraw the entire balance, slide the dot below the amount to the right until it reaches 100%. Select the most appropriate option for ‘Reason for Withdrawal?’ If you’re unsure, selecting ‘Transfer to Personal Wallet’ should suffice.

Then, you’ll see the screen to input the destination address. Please enter the address of your recipient’s exchange account or wallet. In the ‘Label/Note/Name’ field at the top, give it a name that will help you identify this address later. Then, add the address.

And then, click on ‘Continue’ at the bottom right. If you have two-factor authentication set up, you may be prompted to enter a code. Once completed, the funds will be sent to the address immediately.

Buying ans Selling

To buy or sell cryptocurrencies on Swyftx, follow these steps:

- Login to Your Account: First, login to your Swyftx account using your credentials.

- Navigate to the Trading Interface: Once logged in, navigate to the trading interface. This is usually accessible through the main dashboard or the trading section of the platform.

- Select the Cryptocurrency Pair: Choose the cryptocurrency pair you want to trade. For example, if you want to buy Bitcoin with Australian dollars, select the BTC/AUD pair.

- Choose the Order Type: Decide on the type of order you want to place. Swyftx typically offers market orders, limit orders, and stop orders. A market order will execute immediately at the current market price, while a limit order allows you to set a specific price at which you want to buy or sell. A stop order triggers a market order once the price reaches a certain level.

- Enter the Order Details: Enter the amount you want to buy or sell and specify any other relevant details, such as the price for a limit order.

- Review and Confirm: Review your order details to ensure everything is correct, including the amount, price, and order type.

- Place the Order: Once you’re satisfied with the order details, place the order. If it’s a market order, it will execute immediately at the current market price. If it’s a limit order, it will be placed on the order book until the price reaches your specified level.

- Monitor Your Orders: After placing the order, monitor its status in the “Orders” section of the platform. You can track whether it has been filled or if it’s still open.

- Manage Your Portfolio: Keep an eye on your portfolio and make any necessary adjustments based on market conditions or your investment strategy.

Remember to consider the risks associated with trading cryptocurrencies and to conduct thorough research before making any investment decisions.

Trading

I’ll explain using an example of buying and selling Bitcoin with Australian dollars. The process is the same for other currencies as well.

Select “Trade” from the menu, then choose “Buy” if you’re purchasing Bitcoin or “Sell” if you’re selling. The current price of the currency will be displayed along with the balance in your account (either in Australian dollars or Bitcoin) below it.

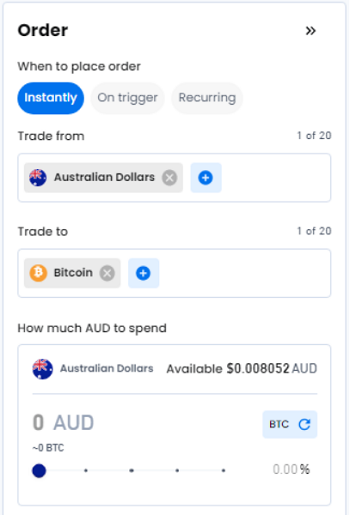

Instantly (Market Order)

The “Instantly” option under the Order section is a market order. In a market order, when buying, you purchase at the current market price without specifying a buy price. In reality, your buy order will be executed at the best available price offered by sellers on the exchange at that moment. Execution refers to the confirmation of the order.

For the “Instantly” option when selling, it represents a market order, where you sell at the current market price without specifying a sell price. In practice, your sell order will be executed at the best available price offered by buyers on the exchange at that moment. Execution occurs when the order is confirmed.

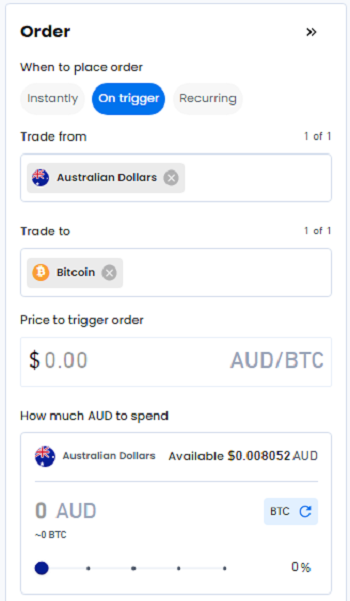

On trigger (Limit Order)

The “On trigger” option in the Order section represents a limit order, where you specify a buy price for buying or a sell price for selling. When buying, you place an order with a specified buy price. This is used when you want to buy at a price lower than the current market price, so you specify the desired price and place the order.

For selling with the “On trigger” option, also known as a limit order, you specify a sell price to place the order. This is used when you want to sell at a price higher than the current market price, so you specify the desired price and place the order.

The orders placed with a limit order remain open until they are executed, meaning until a buy or sell order at the specified price is matched. These open orders are listed in the “Open orders” section. If the market price does not move to the desired price, the order remains unmatched. You have the freedom to cancel unmatched orders at any time.

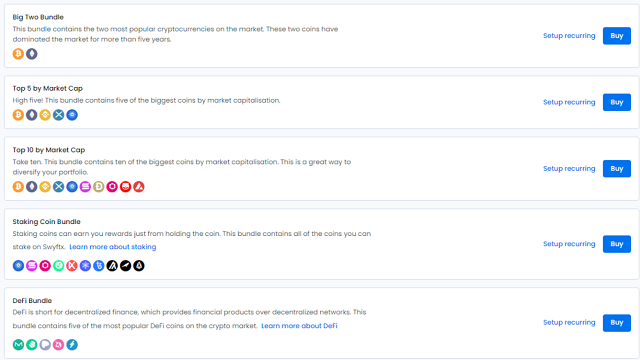

Bundles

Bundles are sets that allow you to purchase multiple currencies grouped together in a single transaction.

Swyftx offers various bundles, including bundles that allow you to purchase top market cap coins like Bitcoin and Ethereum together, bundles consisting of top altcoins by trading volume on Swyftx, DeFi (Decentralized Finance) bundles, and bundles featuring coins with staking capabilities that provide rewards for holding.

The purchase method for bundles is limited to market orders only, also known as “Instantly.” When you click “BUY,” market orders for each currency in the bundle are simultaneously placed. For example, if you’re purchasing a bundle containing five currencies, your funds will be divided equally, with 20% allocated to each currency, and market orders will be placed for each currency accordingly.

Indeed, bundles are comprised of carefully selected currencies that are considered promising. With the vast number of cryptocurrency options available, it can be overwhelming to decide what to buy, and conducting research for each individual asset can be cumbersome. Bundles offer a convenient solution for those who find it challenging to determine which assets to purchase or who find placing individual orders tedious.

Demo Mode

Swyftx offers a demo mode where users can simulate trading without using real money. To access the demo mode, simply toggle the “Demo Mode” option located in the top right corner of the screen by clicking on the gear icon. Once activated, you will be provided with a simulated deposit of approximately AUD $14,000 in virtual funds to use for trading.

Exactly, the demo mode on Swyftx serves multiple purposes. It can be used by beginners to learn how to navigate and operate the platform effectively for cryptocurrency trading. Additionally, it provides a risk-free environment for practicing virtual currency trading strategies and gaining confidence before engaging in real trading with actual funds.

The actual operation method is very simple and easy to understand, so those who have experience in forex or stock trading, or who are already trading on other cryptocurrency exchanges, should have no problem using it proficiently without practicing in demo mode.

Also, by turning on the Dark Mode option, which can be found under the same gear icon, the background changes from white to black. Please use it according to your preference.

Summary

Introduced Swyftx, a popular exchange that has gained high praise among Australian consumers and continues to increase its volume of supported cryptocurrencies.

- Beginner-friendly

- Fast account opening process

- Supports over 300 cryptocurrencies

- Low trading fees (0.6%)

- Instant withdrawals in Australian dollars

- High liquidity with narrow spreads

- Includes charting tools

- Practice available with demo trading

Swyftx is a must-have exchange for trading cryptocurrencies like Bitcoin and Ethereum in Australian dollars.

Swyftx

https://swyftx.com.au/